Christmas and the Spirit of Giving

Posted By Norman Gasbarro on December 25, 2015

In this Christmas season, don’t forget to reward your local historical society with a tax-deductible gift. That gift can either be monetary, goods, or services.

To determine whether a historical society is a legitimate 501(c)3 organization, properly registered with the Internal Revenue Service (IRS), the IRS provides current, on-line information about each group in this status. The information is most easily found on the web site Charity Navigator, which downloads the data directly from the IRS web site and which also rates the larger organizations.

The best advice that can be given is to check the IRS status of any organization before donating to it. Just because an organization is properly registered doesn’t mean it is doing everything properly, but if an organization is not listed and is improperly claiming that they are a 501(c)3 organization, that should be a warning sign that they are operating fraudulently and criminal charges could be brought against the officers and directors of the group.

For six local historical societies in the Lykens Valley area, five are properly registered and one is not. The link to the Charity Navigator page (“Tax Information”) for each of the properly registered organizations is provided below.

Tax information provided on Charity Navigator includes the Employer Identification Number (EIN) of the organization, address, type of services offered, foundation status, ruling determination date, declared asset amount, income in most recent year, last Form 990 Return filed, and copies of last five Form 990s received by the IRS.

———————————-

The following historical societies are…

RECOMMENDED – Contributions are Tax Deductible

For all of the historical societies in this category, information is readily available on the web and contact persons are easily identifiable. Click on one or more of the categories following the organization name for further information, including the required information annually given to the IRS (“Tax Information”).

Elizabethville Area Historical Society. Web Site, Facebook, & Contact Information. Tax Information.

Halifax Area Historical Society. Facebook. Contact Information. Tax Information.

Historical Society of Millersburg and Upper Paxton Township. Web Site, Facebook, & Contact Information. Tax Information.

Lykens-Wiconisco Historical Society. No Web Site. Contact Information. Tax Information.

Pillow Historical Society. Web Site. Contact Information. Tax Information.

————————————-

The following historical society is…

NOT RECOMMENDED – Contributions are Not Tax Deductible

Gratz Historical Society. No Web Site. No phone. No e-mail. Presently closed. Contact Through P.O. Box Only.

Although the Gratz Historical Society claims it is registered with the IRS as a 501(c)3 organization under the IRS Code and that all contributions to GHS are tax deductible, when asked, it has failed to produce a required “Letter of Determination” giving them that status. Annual tax returns (Form 990, or Form 990-N) are required of all 501(c)3 organizations since 2008, but the Gratz Historical Society has never filed any tax returns with the IRS. They are not listed on Charity Navigator as a legitimate, charitable organization under the Tax Code and the IRS does not recognize them as such.

——————————–

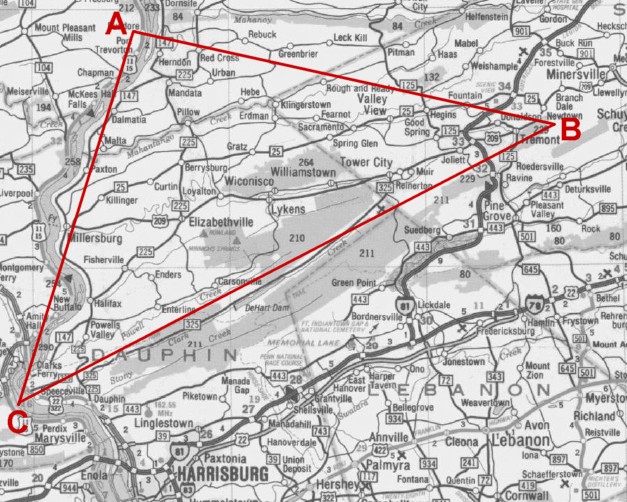

Note: There are three other historical societies that fall within the geographical triangle of the Civil War Research Project. Links are provided to the Charity Navigator page, where appropriate. If no link is provided, an explanation of status is given as best known from information given by the current society officers.

- Tremont Area Historical Society (Tremont, Pennsylvania)

- Mahanoy and Mahantongo Historical and Preservation Society, Inc. (Dalmatia, Pennsylvania)

- Williamstown and Williams Township Historical Society (Williamstown, Pennsylvania). This organization is working on reconstructing documents lost by past officers who did not properly care for them. These documents are needed to apply for 501(c)3 status with the Internal Revenue Service. The organization and its leaders do not claim that contributions are tax-deductible nor to the best knowledge of the current officers has anyone ever claimed that contributions are tax-deductible.

;

;

Comments